Insurance contract renewals from January 1, 2022: limitations are already underway

Since the first semester of 2019, the insurance market started an upward trend in Europe: prices have increased, and covers have been more limited. In this context, insurance companies have been reviewing their contracts and programs to the detriment of policyholders, who experienced broader limitations and poorer covers since 2020. We published a synthetic study on this subject in May 2020; here is an update.

A downward cycle of unprecedented duration

For more than 15 years, until 2019, there was an unprecedented decline in contract prices. This downward price cycle, which lasts 8 years on average, can be explained by several reasons such as an excess of liquidity after the 2008 crisis, intense competitive pressure, and the good performance of financial markets. Nevertheless, this cycle ended in 2017 with an increase in prices by insurers that started in Asia before spreading to Europe, in 2019. This increase is above all the consequence of the regular reversal of cycles, specific to the insurance market.

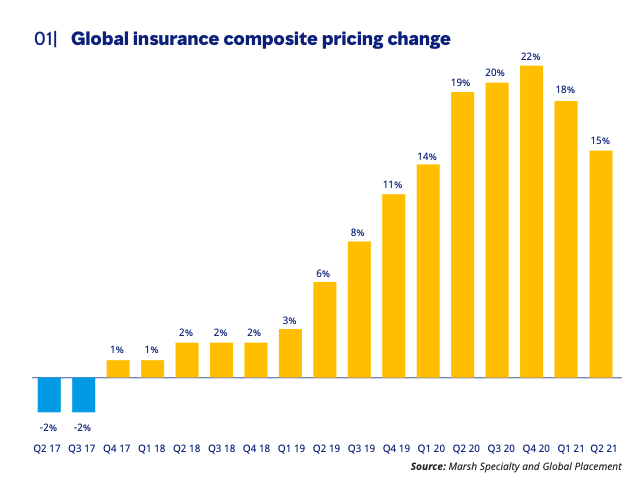

According to broker Marsh’s quarterly report, worldwide “commercial” insurance prices rose 22% in Q4 2020, 18% in Q1 2021, and 15% in Q2 2021, marking the 15th consecutive quarter of rate increases in the global insurance market.

Sharp increase in global insurance prices

The global insurance market is growing rapidly. This has also led to a change in pricing for major insurance product categories. If we compare the 2nd quarter of 2019 and the 2nd quarter of 2021 with the available data, we can see a strong increase in prices:

- Property insurance: +4%

- Casualty insurance: +5%

- FinPro insurance: +24,3%

Insurance companies’ means of action

In a growing insurance market, insurers have several means of action regarding contract renewal:

- Increase premium prices while providing the same cover. This is particularly the case for so-called sensitive risks, which show a high claims ratio and a poor level of prevention, while being exposed to natural disasters or Contingent Business Interruption.

- Insurers also can reduce the amounts covered and introduce more and broader limitations, or exclusions, as well as more restrictive guarantees. This was particularly the case during the health crisis, where insurers have decided to exclude the consequences of COVID-19 in the January 2021 policy renewal.

- The quasi-disappearance of Long Term Agreements (“LTA”), as insurers anticipate a price increase for the coming years.

- The standardization of insurance products in which the past performance of the policyholder is no longer taken into account. The growth of affinity insurance, and insurance distributed through the web, facilitates this trend. Contracts are becoming less negotiable and therefore more binding for the policyholder, including, increasingly, companies.

- The control of the contractual calendar. Premium increases are rarely announced in advance by insurers to each policyholder. Many companies are therefore caught in the middle: they either accept the increase or have to find a “plan B” within a very short period of time, sometimes a few days or weeks.

Carpet bombing by insurance companies will intensify

The global increase in premiums is not directly related to the current health crisis or to the natural disasters that have been affecting Europe for several months. According to Aon Reinsurance Solutions’ report of August 10, the recent natural disasters in Europe will cost the insurance market about $15 billion. However, Munich Re’s CFO, Christoph Jurecka, claims that “the floods will cause some price adjustment in Europe, so pricing will increase more than we have seen in the past”.

It is likely that the insurance community will strongly emphasize the natural disasters, and then the annual reinsurance contract negotiations (at the end of September in Monaco) to justify a structural price increase by the current situation.

Anticipating these increases, and the contractual restrictions that accompany them, is therefore the main topic of the fall for financial and legal departments, as 70% of French companies’ insurance contracts are renewed on January 1, and the notice periods are usually two or three months.